Abandonment

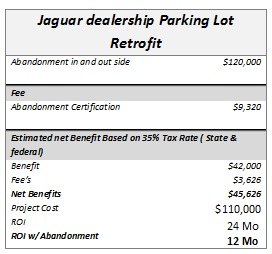

Abandonment deductions enable a business to take a deduction on any property placed into service and then taken out of service before being fully depreciated over the course of its respective useful life. When assets are retired or removed, they are taken off a company’s books (when you relight a facility, you essentially remove the old lighting). Smart Energy Technologies calculates the value of these retired assets and provides all of the necessary documentation needed to claim these tax deductions.

1245/1250

Often when a property is renovated or built some of the additions are considered personal property by the IRS. These assets know as 1245 category assets can be depreciated much faster than the conventional lighting in a building. Not all lighting qualifies as a 1245 asset, but in retail and some other specific location the benefits can be significant.

Repairs vs. Capitalization

Application of the new repair regulations requires an in-depth understanding of various tax cases and “circumstances” that must be met. Structural components of a building include items with a long tax life (generally 39, 27.5 or 15 years) such as lighting, roofs, HVAC systems, interior and exterior walls, etc. The new regulations allow you to assign a value to those items and write them off when replaced.

Improvements

The regulations continue to require capitalization of amounts paid to improve a unit of tangible property. A unit of property is improved if amounts are paid for activities performed by the taxpayer resulting in:

Betterment

Betterment

- Amelioration of Pre-Existing Defect

- Material Addition: Expansion/Enlargement

- Material Increase in Productivity or Quality

- Routine Maintenance – Safe Harbor

- Building Refresh

Restoration

Replacement of Component for Which Loss Recognized on Disposition or Casualty

- State of Disrepair: No Longer Functional for its intended use

- Restored to “Like-New” after end of ADR life

- Replacement of Major Component or Substantial Structural Part

Adaptation

- New Use Not Consistent with Taxpayer’s Original Intended Ordinary Use

- Change to a new of different purpose

Conclusion

To take the deductions you need a 3rd party who completes a certified report, you cannot use bonus depreciation for lighting. Smart Energy Technologies brings to you significant savings and benefits when relighting or building a new building.